All Categories

Featured

Table of Contents

Tax lien investing can offer your profile direct exposure to realty all without having to really own property. Specialists, nevertheless, claim the procedure is complicated and advise that beginner financiers can conveniently obtain burned. Right here's whatever you require to understand about buying a tax lien certificate, consisting of exactly how it works and the risks entailed.

The notice usually comes prior to harsher activities, such as a tax levy, where the Internal Profits Solution (IRS) or local or municipal governments can in fact seize somebody's building to recoup the financial obligation. A tax obligation lien certification is developed when a homeowner has fallen short to pay their tax obligations and the city government concerns a tax lien.

Tax obligation lien certificates are usually auctioned off to capitalists looking to profit. To recuperate the delinquent tax dollars, towns can after that sell the tax obligation lien certification to private investors, who take care of the tax bill for the right to accumulate that money, plus interest, from the residential property proprietors when they at some point repay their equilibrium.

What Is Tax Lien Real Estate Investing

allow for the transfer or assignment of overdue property tax liens to the private industry, according to the National Tax Obligation Lien Organization, a not-for-profit that stands for federal governments, institutional tax obligation lien investors and servicers. Here's what the procedure looks like. Tax obligation lien investors need to bid for the certificate in an auction, and how that process works depends on the details municipality.

Call tax officials in your area to make inquiries just how those delinquent taxes are gathered. Public auctions can be on the internet or face to face. In some cases winning bids go to the financier going to pay the most affordable rates of interest, in an approach called "bidding down the rate of interest." The municipality develops an optimum price, and the bidder providing the most affordable rates of interest underneath that maximum wins the auction.

The winning bidder has to pay the entire tax costs, consisting of the delinquent financial obligation, passion and fines. The capitalist has to wait until the building owners pay back their entire balance unless they do not.

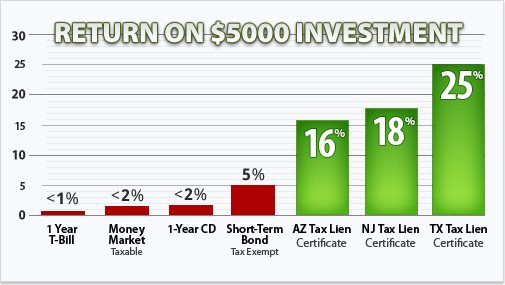

While some investors can be compensated, others may be captured in the crossfire of challenging rules and loopholes, which in the worst of situations can bring about substantial losses. From a mere profit point ofview, many financiers make their cash based on the tax lien's rates of interest. Rate of interest differ and depend on the territory or the state.

Earnings, nonetheless, don't always total up to returns that high during the bidding process. In the end, most tax obligation liens acquired at public auction are marketed at prices between 3 percent and 7 percent across the country, according to Brad Westover, executive supervisor of the National Tax Lien Association. Before retiring, Richard Rampell, formerly the president of Rampell & Rampell, a bookkeeping firm in Palm Beach, Florida, experienced this direct.

Best States For Tax Lien Investing

Initially, the companions succeeded. Then huge institutional financiers, consisting of banks, hedge funds and pension plan funds, went after those higher returns in auctions around the country. The larger capitalists assisted bid down rates of interest, so Rampell's group had not been making significant money anymore on liens. "At the end, we weren't doing better than a CD," he states - real estate tax lien investments for tax-advantaged returns.

That hardly ever happens: The tax obligations are usually paid prior to the redemption day. Liens additionally are first in line for payment, even before home loans. Also so, tax obligation liens have an expiration date, and a lienholder's right to seize on the home or to gather their financial investment runs out at the exact same time as the lien.

"Sometimes it's 6 months after the redemption duration," Musa states. "Do not assume you can just acquire and neglect about it." Private financiers who are taking into consideration financial investments in tax obligation liens should, above all, do their homework. Specialists suggest preventing properties with ecological damage, such as one where a gasoline station unloaded unsafe material.

How Does Tax Lien Investing Work

"You should really comprehend what you're purchasing," claims Richard Zimmerman, a companion at Berdon LLP, an audit company in New york city City. "Know what the residential property is, the community and worths, so you do not acquire a lien that you will not be able to gather." Potential financiers must likewise inspect out the residential property and all liens versus it, along with current tax sales and sale costs of comparable residential or commercial properties.

"Individuals obtain a listing of residential properties and do their due diligence weeks before a sale," Musa says. "Half the properties on the listing might be gone because the tax obligations get paid.

Profit By Investing In Tax Liens

Westover says 80 percent of tax obligation lien certificates are offered to participants of the NTLA, and the company can often compare NTLA participants with the best institutional capitalists. That might make taking care of the procedure less complicated, particularly for a newbie. While tax lien financial investments can offer a generous return, understand the fine print, details and rules.

"But it's made complex. You have to understand the information." Bankrate's added to an upgrade of this tale.

Residential or commercial property tax obligation liens are an investment particular niche that is forgotten by most financiers. Getting tax obligation liens can be a financially rewarding though relatively danger for those that are experienced about realty. When individuals or organizations fall short to pay their real estate tax, the districts or various other federal government bodies that are owed those tax obligations put liens against the properties.

Risks Of Investing In Tax Liens

These claims on security are likewise traded among investors who want to generate above-average returns. Through this procedure, the community obtains its tax obligations and the capitalist gets the right to accumulate the amount due plus rate of interest from the borrower. The process hardly ever ends with the capitalist confiscating possession of the residential or commercial property.

Liens are offered at public auctions that often include bidding wars. If you need to confiscate, there may be various other liens versus the home that keep you from occupying. If you get the home, there might be unexpected expenses such as fixings and even forcing out the present owners. You can additionally spend indirectly using residential or commercial property lien funds.

It properly links up the building and prevents its sale up until the proprietor pays the taxes owed or the building is taken by the financial institution. For instance, when a landowner or house owner falls short to pay the taxes on their home, the city or county in which the building lies has the authority to place a lien on the residential or commercial property.

Home with a lien affixed to it can not be offered or refinanced up until the tax obligations are paid and the lien is eliminated. When a lien is issued, a tax lien certificate is produced by the municipality that shows the amount owed on the home plus any kind of rate of interest or penalties due.

It's approximated that an added $328 billion of building taxes was examined across the United state in 2021. It's hard to evaluate nationwide property tax obligation lien numbers.

Latest Posts

Qualified Purchaser

What Is Tax Lien Certificate Investing

Sec Rule 501 Of Regulation D