All Categories

Featured

Table of Contents

RealtyMogul's minimum is $1,000. The remainder of their business realty deals are for certified financiers just. Right here is a comprehensive RealtyMogul introduction. If you want broader property direct exposure, after that you can take into consideration acquiring an openly traded REIT. VNQ by Lead is just one of the largest and popular REITs.

Their leading holding is the Lead Realty II Index Fund, which is itself a common fund that holds a variety of REITs. There are various other REITs like O and OHI which I am a veteran shareholder of. REITs are a very easy method to get property direct exposure, yet it does not have the exact same quantity of focus as eREITs and private business property offers.

To be an accredited investor, you need to have $200,000 in annual revenue ($300,000 for joint capitalists) for the last 2 years with the expectation that you'll earn the exact same or a lot more this year. You can likewise be taken into consideration a certified capitalist if you have a web worth over $1,000,000, separately or collectively, omitting their main residence.

How does Accredited Investor Real Estate Deals work for high-net-worth individuals?

These deals are usually called exclusive positionings and they don't require to register with the SEC, so they do not provide as much information as you would certainly anticipate from, claim, an openly traded firm. The certified capitalist need assumes that someone who is recognized can do the due diligence on their very own.

You just self-accredit based upon your word. The SEC has also increased the meaning of certified financier, making it simpler for more people to qualify. I'm bullish on the heartland of America give after that reduced valuations and a lot higher cap prices. I think there will certainly be continued movement away from high price of living cities to the heartland cities because of set you back and innovation.

It's everything about complying with the cash. In addition to Fundrise, also look into CrowdStreet if you are an accredited capitalist. CrowdStreet is my favorite system for recognized capitalists since they focus on arising 18-hour cities with lower appraisals and faster populace growth. Both are cost-free to sign up and explore.

Below is my property crowdfunding control panel. If you intend to discover more concerning genuine estate crowdfunding, you can visit my realty crowdfunding learning facility. Sam operated in spending banking for 13 years. He obtained his undergraduate degree in Business economics from The University of William & Mary and got his MBA from UC Berkeley.

He hangs out playing tennis and looking after his family members. Financial Samurai was begun in 2009 and is one of the most trusted personal financing websites online with over 1.5 million pageviews a month.

Trick Takeaways What are thought about the ideal realty investments? With the united state actual estate market on the rise, investors are filtering via every available home type to uncover which will certainly aid them profit. So which fields and properties are the most effective actions for financiers today? Keep reviewing to get more information about the best kind of real estate financial investment for you.

Why are Exclusive Real Estate Crowdfunding Platforms For Accredited Investors opportunities important?

Each of these kinds will come with one-of-a-kind advantages and downsides that capitalists need to examine. Allow's check out each of the alternatives available: Residential Realty Commercial Real Estate Raw Land & New Construction Property Investment Company (REITs) Crowdfunding Systems Register to participate in a FREE on the internet property course and discover just how to begin purchasing property.

Other houses include duplexes, multifamily properties, and trip homes. Residential realty is perfect for lots of investors because it can be easier to transform revenues regularly. Certainly, there are several property genuine estate investing approaches to deploy and different degrees of competition throughout markets what might be best for one financier might not be best for the next.

Accredited Investor Real Estate Income Opportunities

The best business properties to buy include industrial, workplace, retail, hospitality, and multifamily projects. For financiers with a strong concentrate on improving their local communities, commercial realty investing can sustain that focus (Residential Real Estate for Accredited Investors). One factor business homes are considered among the ideal kinds of realty financial investments is the potential for higher capital

For more information about obtaining begun in , be certain to review this write-up. Raw land investing and brand-new building represent two kinds of property financial investments that can diversify an investor's portfolio. Raw land refers to any type of uninhabited land offered for purchase and is most attractive in markets with high forecasted growth.

Spending in new building and construction is likewise preferred in quickly expanding markets. While several investors may be not familiar with raw land and brand-new building and construction investing, these financial investment kinds can stand for appealing earnings for investors. Whether you are interested in establishing a property from beginning to end or benefiting from a long-term buy and hold, raw land and new construction offer a special possibility to actual estate investors.

Who offers the best Residential Real Estate For Accredited Investors opportunities?

This will certainly ensure you pick a desirable area and stop the financial investment from being hindered by market factors. Genuine estate financial investment trusts or REITs are business that own different business property kinds, such as hotels, shops, offices, shopping centers, or dining establishments. You can purchase shares of these property business on the stock market.

This provides investors to get dividends while expanding their portfolio at the very same time. Publicly traded REITs additionally provide adaptable liquidity in contrast to various other types of genuine estate financial investments.

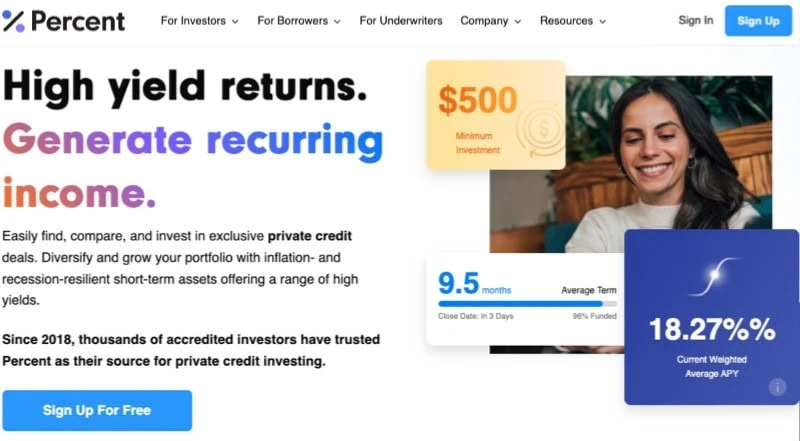

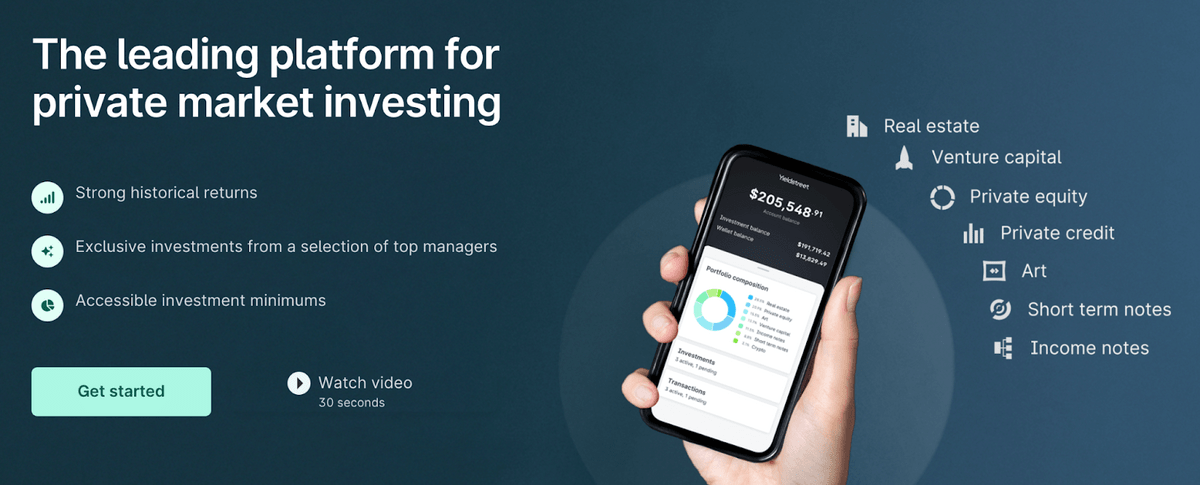

While this uses the ease of discovering assets to investors, this type of property investment likewise presents a high amount of risk. Crowdfunding platforms are normally limited to approved investors or those with a high web worth. Some websites provide access to non-accredited investors. The main sorts of property investments from crowdfunding platforms are non-traded REITs or REITs that are out the stock market.

Is High-return Real Estate Deals For Accredited Investors worth it for accredited investors?

[Learning how to buy actual estate doesn't need to be hard! Our on the internet property spending class has whatever you need to reduce the knowing contour and start buying realty in your area.] The most effective sort of genuine estate financial investment will depend on your individual situations, objectives, market area, and preferred investing strategy.

Selecting the best property kind boils down to considering each alternative's pros and disadvantages, though there are a few vital elements capitalists need to bear in mind as they seek the ideal option. When picking the most effective sort of financial investment property, the value of location can not be understated. Financiers operating in "up-and-coming" markets might locate success with vacant land or brand-new construction, while investors operating in more "mature" markets might have an interest in houses.

Examine your recommended degree of involvement, risk tolerance, and earnings as you choose which property type to purchase. Investors desiring to take on an extra easy duty may opt for buy and hold business or houses and employ a residential property supervisor. Those wanting to take on a much more active function, on the various other hand, might discover establishing uninhabited land or rehabbing household homes to be much more fulfilling.

Latest Posts

Tax Lien Investing Online

Foreclosure Overages List

Real Estate Tax Lien Investments For Tax-advantaged Returns